| By Christopher Vecchio, DailyFX Currency Analyst

Today is the day we've been waiting on for since late-July. Back then, European Central Bank President Mario Draghi promised to do "whatever it takes" to save the Euro, and today's meeting is expected to reveal the technical details of the plan that should buy more time for the struggling Italian and Spanish economies. As per a report by Bloomberg News yesterday, the ECB will be unlimited quantities of securities whose maturities are three-years or less, but sterilize (or offset) the bond purchases with sales elsewhere. Will this be effective?

We think not. An unlimited sterilized bond-buying program is nothing more a version of the Federal Reserve's Operation Twist, and as Goldman Sachs called it yesterday, "SMP 2.0." "SMP 1.0" was the securities market program that was in effect in late-2011 and early-2012, which soaked up peripheral debt in the secondary markets. However, just like the longer-term refinancing operations (LTROs 1 and 2), the first iteration of the SMP proved to be ineffective: if they were effective, we wouldn't be discussing the fourth major program to be announced over the past year.

Despite the rumored plan which would see the ECB buy shorter-dated securities, specifically with maturities of three-years or less, peripheral European bonds have weakened. The Italian 2-year note yield has increased to 2.504% (+13.0-bps) while the Spanish 2-year note yield has increased to 3.043% (+7.3-bps). Conversely, the Italian 10-year note yield has decreased to 5.460% (-3.1-bps) while the Spanish 10-year note yield decreased to 6.244% (-10.7-bps); lower yields imply higher prices. RELATIVE PERFORMANCE (versus USD): 10:37 GMT AUD: +0.47%

NZD:+0.26%

CAD:+0.22%

EUR:+0.15%

CHF:+0.12%

GBP:+0.04%

JPY: -0.10%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.13% (-0.33% past 5-days) ECONOMIC CALENDAR There are several important data releases this morning that could force major moves across the spectrum. At 07:00 EDT / 11:00 GMT, and perhaps the least important event on the day, the Bank of England Rate Decision is due, where rates will remain on hold at 0.50%. At 07:45 EDT / 11:00 GMT, the European Central Bank Rate Decision is due, followed by President Mario Draghi's Press Conference at 08:30 EDT / 12:30 GMT. Read my full thoughts here. At 08:15 EDT / 12:15 GMT, the USD ADP Employment Change report for August will be released, and is expected to show a modest uptick in private sector jobs. At 08:30 EDT / 12:30 GMT, the USD Initial Jobless Claims report for the week ending September 1 is due, and is expected to show improvement. At 10:00 EDT / 14:00 GMT, the USD ISM Non-manufacturing Composite for August will be released, and is expected to show growth, albeit at a slightly weakened pace.

TECHNICAL OUTLOOK

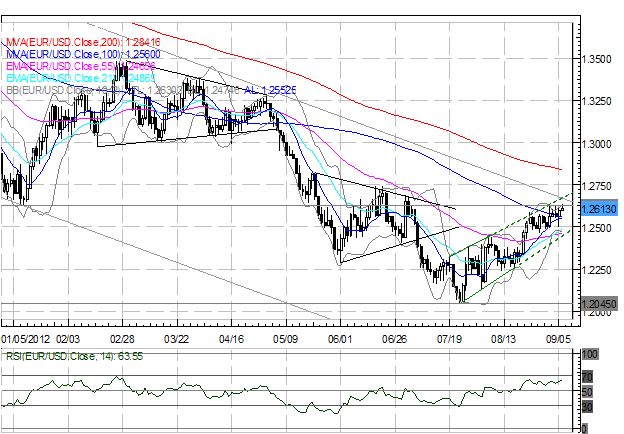

BB represents Bollinger Bands ® As noted earlier this week, "The Bull Flag previously noted within the EURUSD ascending channel/wedge off of the July 24 low has broken to the upside, with a test of 1.2600 line as with potential for 1.2625/35. Still, there is a potential Inverse Head & Shoulders pattern in the works since late-June. Given the Head at 1.2040/45, this would draw into focus 1.2760 (would come amid a major breakout) as long as price holds above 1.2405. Interim resistance comes in at1.2625/35 (former yearly lows, last week's high) and 1.2660/75 (long-term descending channel resistance). Near-term support comes in at 1.2560, 1.2500, 1.2440/45 (former swing highs), 1.2405 (Neckline), 1.2310/30, 1.2250/65, and 1.2155/70." USDJPY:

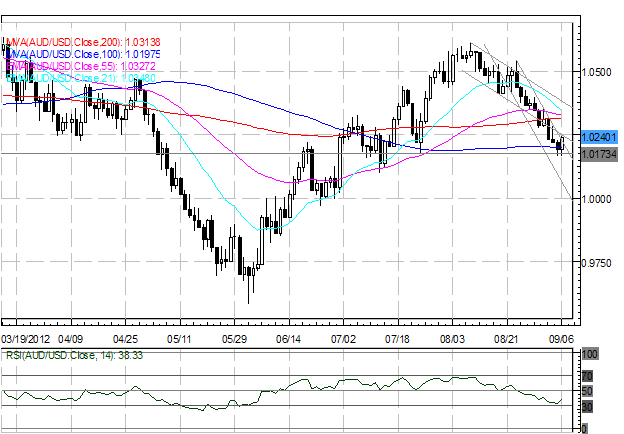

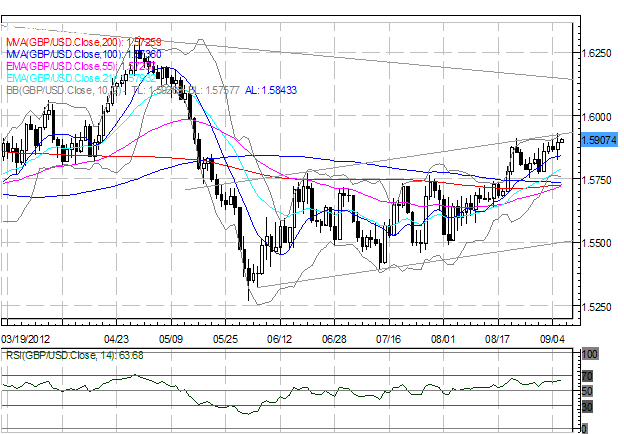

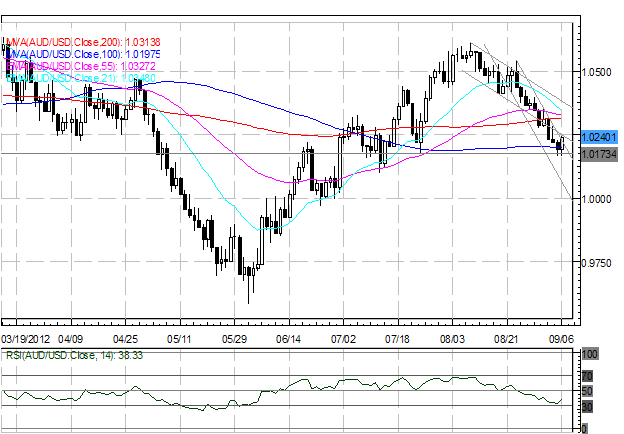

As noted earlier this week, "The USDJPY closed below the key 78.60 level yesterday for the second consecutive day, exposing former swing lows near 78.10/20, as expected. This level coincides with former June swing lows and a level of resistance for most of July (note the daily wicks above said level but no closes). For now, this is the most important level: potential exists for a rally back into 79.10/20 as long as 78.60 holds, whereas a daily close below suggests a move towards 78.10/20 at the minimum. Penetration of the August low at 77.90 will likely result in a washout to new lows with the potential for 77.65/70 and 77.30." With little changed, "The GBPUSD continues to push higher towards topside channel resistance, as expected. We do believe, however, that this is the "final push higher before the next leg lower." Key levels for the near-term are 1.5880/1.5900 to the upside and 1.5770/90 to the downside; we are continuing to become overextended on shorter-term charts, suggesting that another failure at 1.5900 could lead to profit taking before further bullish price action. A daily close below 1.5770/90 over the coming days should lead to a drop into 1.5700/20. Beyond that, support comes in at 1.5635/40 (last week's low), and 1.5625 (ascending trendline support off of August 6 and August 10 lows). A daily close above 1.5900 points towards 1.5985." AUDUSD:  The AUDUSD has broken down even further today, fading the entire RBA bounce. Although price has found support at the 100-DMA, a new downtrend is in place now that the pair has closed below the 200-DMA for multiple days. Near-term resistance comes in at 1.0275/90, 1.0345, 1.0420 1.0480, 1.0530/45 (former swing highs, and would also represent a break of the downtrend off of the August 9 high), and 1.0600/15 (August high). Near-term support comes in at 1.0195/1.0200 (100-DMA), 1.0160/75 (late-July swing low, this week's low) and 1.0100 (mid-July swing low).

--- Written by Christopher Vecchio, DailyFX Currency Analyst

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this email are provided as general market commentary, and do not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content in this email is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dailyfx has taken reasonable measures to ensure the accuracy of the information, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the content, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this email. Please read the full disclosures here. Additionally, Dailyfx takes your privacy seriously. Please click here to read our privacy policy. |  Related Blog Posts Related Blog Posts |  Subscribe via RSS Subscribe via RSS *Get live updates in your web browser window. | |

Leave a comment