| By Christopher Vecchio, DailyFX Currency Analyst

Risk is firmly on today with positive signs across the board, from bonds to stocks, from currencies to...well, precious metals aren't buying the developments over the past few days. While the Australian Dollar and the Euro are leading the charge higher against the traditional safe havens, the Japanese Yen, the Swiss Franc, and the US Dollar, Gold and Silver have sold off a bit through the Asian and European sessions.

This comes as a bit of a surprise, considering the promise of additional stimulus, which has usually come in the form of more liquidity from central banks, typically sends investors into precious metals as hedges against fiat dilution. We thus suspect that despite the time buying measures from the European Central Bank yesterday and the Chinese government today (in announcing a ¥1 trillion yuan infrastructure stimulus package) are being largely overlooked in favor of key labor market data out of the United States ahead of the US cash equity open this morning. The US Nonfarm Payrolls report isn't just key for Gold and Silver; it is crucial for the Federal Reserve's policy meeting next week.

How important is labor market data to the Federal Reserve? In his key address at the Jackson Hole Economic Policy Symposium, Federal Reserve Chairman Ben Bernanke argued that not only has quantitative easing helped the US economy, that withstanding a further improvement in the US employment situation, more easing could deployed. Hence, the importance of today's Nonfarm Payrolls report for August. According to a Bloomberg News Survey, +130K jobs were added last month, while +163K jobs were added in July. Similarly, the Unemployment Rate is expected to remain on hold at 8.3%. The decline in jobs growth is discouraging, but the four-week average rose to +95.5K in August from +90.5K in July, suggesting that the recent slowdown may be over. If this is a weak figure, the US Dollar will be hit very hard.

Taking a look at credit, bond markets are giving their sign of approval, thus far, to the ECB's plans. The Italian 2-year note yield has increased to 2.164% (+2.5-bps) while the Spanish 2-year note yield has decreased to 3.734% (-3.8-bps). On the longer-end of the curve, the Italian 10-year note yield has decreased to 5.106% (-13.2-bps) while the Spanish 10-year note yield has decreased to 5.678% (-28.2-bps); lower yields imply higher prices. RELATIVE PERFORMANCE (versus USD): 11:05 GMT AUD: +0.50%

EUR:+0.49%

NZD:+0.11%

CAD:+0.11%

GBP:-0.04%

JPY:-0.14%

CHF: -0.37%

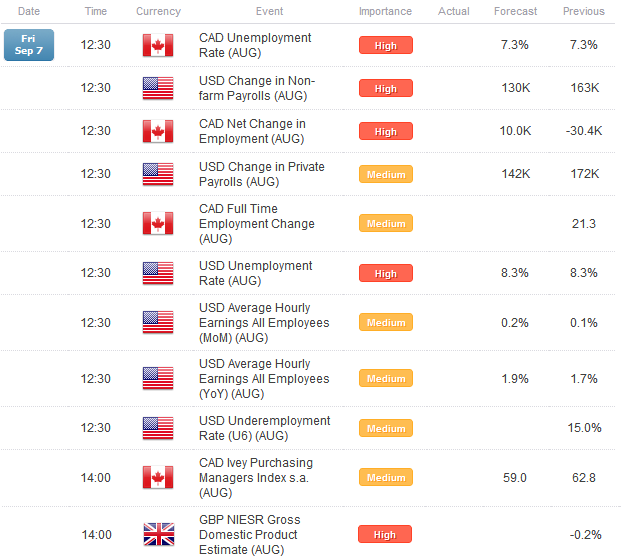

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.16% (-0.13% past 5-days) ECONOMIC CALENDAR There are several important data releases this morning, starting off with labor market data out of Canada and the United States at 08:30 EDT / 12:30 GMT. The CAD Net Change in Employment (AUG) is expected to show a rebound in jobs creation, but the CAD Unemployment Rate (AUG) will be on hold at 7.3%. Meanwhile, the USD Change in Nonfarm Payrolls (AUG) report should show a +142K print from +172K in July, which would leave the USD Unemployment Rate (AUG) unchanged at 8.3%. At 10:00 EDT / 14:00 GMT, the GBP NIESR Gross Domestic Product Estimate (AUG) will be released.

TECHNICAL OUTLOOK

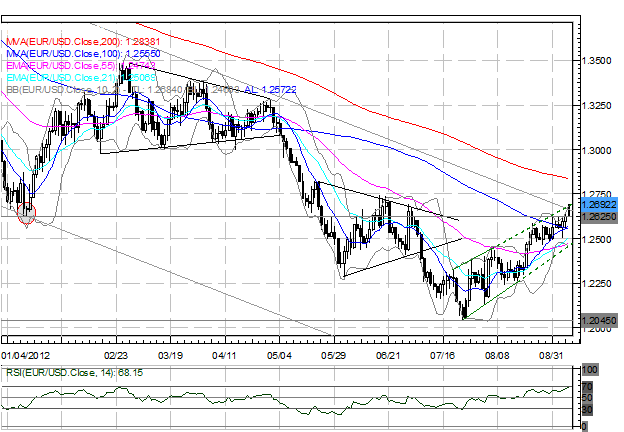

BB represents Bollinger Bands ® The EURUSD has threatening a major breakout today, pushing through formerly yearly lows at 1.2625/30 and the descending trendline off of the August 2011 and October 2011 highs. While this would buck the yearlong downtrend that has been in play up to 1.2740/50 (just below the measured 1.2760 target off of the Inverse Head & Shoulders), there could be some profit taking soon for a small pullback. Overall, with price supported by 1.2440/45, our outlook remains bullish, and a shift in our medium-term bias would be necessary if price closes above 1.2670 today. Near-term resistance comes in at 1.2740/50 (mid-June swing highs), 1.2820/25 (late-May swing highs), and 1.2980/1.3000. Support comes in at 1.2625/30 (former yearly lows), 1.2500/10, and 1.2460/80. USDJPY:

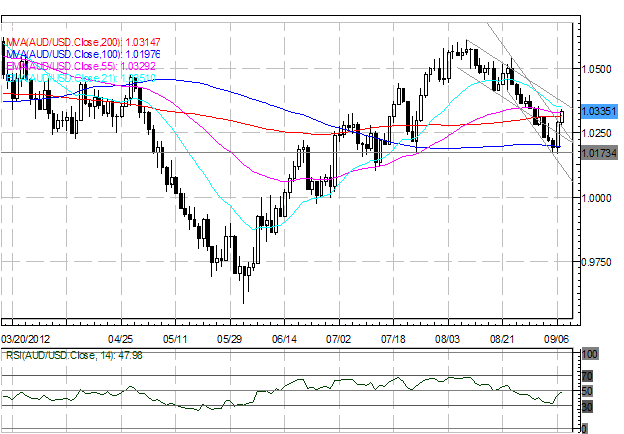

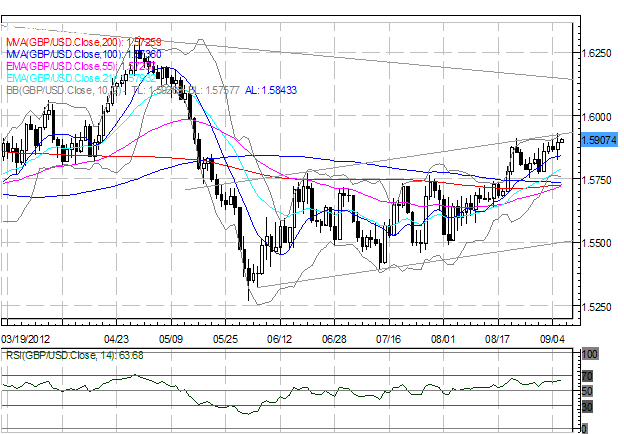

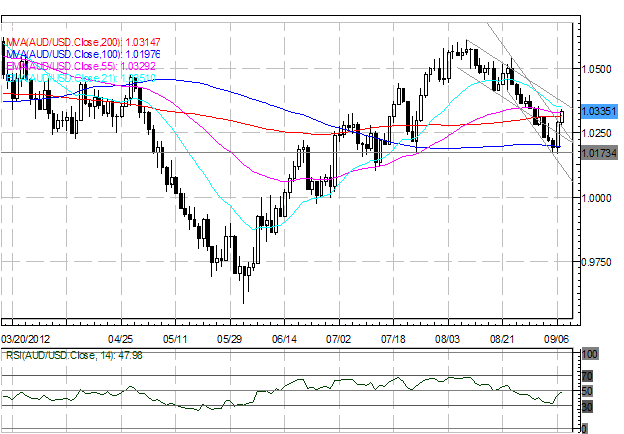

Strong jobs data and some relief in the Euro-zone crisis has helped spur the USDJPY higher, with price closing back above the key 78.60 level yesterday. Now, there is scope for gains into 79.20/30, confluence of the 100-DMA, 200-DMA, and the descending trendline of off the April 20 and June 25 highs. Accordingly, a break of this downtrend is contingent upon strong US labor market data today in the form of the US Nonfarm Payrolls report. A daily close below 78.60 suggests a move towards 78.10/20 at the minimum (a level of demand this week as well as through early-August). Penetration of the August low at 77.90 will likely result in a washout to new lows with the potential for 77.65/70 and 77.30. The GBPUSD finally cracked through topside channel resistance at 1.5900/05 yesterday, but thus far has struggled to produce meaningful gains higher. With an Inverted Hammer forming on the daily chart, there is evidence to believe that a false breakout may have formed. If price fails to eclipse 1.5910 on the close today, there is scope for a pullback towards 1.5770/90. However, a weekly close above said level gives reason to believe that a run up to 1.6120/40 is possible during September. AUDUSD:  The AUDUSD is back on the rebound following Chinese infrastructure stimulus measures, definitively breaking the steep descending channel off of the August 22 high and trading back into its former channel off of the August 9 high. Accordingly, topside resistance comes in at 1.0350/55 (20-DMA), 1.0370/80 (channel resistance) and 1.0410/20 (mid-August swing lows). A breakdown eyes 1.0275/1.0300, 1.0210/25, and 1.0160/75 (weekly low).

--- Written by Christopher Vecchio, DailyFX Currency Analyst

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this email are provided as general market commentary, and do not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content in this email is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dailyfx has taken reasonable measures to ensure the accuracy of the information, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the content, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this email. Please read the full disclosures here. Additionally, Dailyfx takes your privacy seriously. Please click here to read our privacy policy. |  Related Blog Posts Related Blog Posts |  Subscribe via RSS Subscribe via RSS *Get live updates in your web browser window. | |

Leave a comment