| By Christopher Vecchio, DailyFX Currency Analyst

Trading conditions are quiet again as volume levels across global equities remains quite low, suggesting a severe lack of participation in markets today. The environment is not entirely unexpected, however, considering that August, historically, is one of the slower moving months as many traders step away from their desks.

Also typical of trading is that after a big move in one direction, prices usually stop or consolidate, "nothing moves in a straight line." So after yesterday's biggest US Dollar sell-off in two-weeks, largely predicated around immense British Pound and Euro strength, it comes as little surprise that the US Dollar had rebounded slightly today. An Inside Day is being formed on the daily Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) chart, suggesting that any downside pressure is relieved momentarily. This fits neatly in with our perspective for the Federal Open Market Committee August meeting Minutes that will be released today, the single most important event on the docket this week. Mainly, the US Dollar's gain has been revolving around weakness in the commodity currency complex, with the European currencies mostly flat on the day.

In line with the Euro's relatively flat performance, peripheral European debt has stagnated in its recent rally (both the EURJPY and the EURUSD have high negative correlations with shorter-term yields). The Italian 2-year note yield has eased to 2.941% (-0.9-bps) while the Spanish 2-year note yield has fallen to 3.342% (-0.9-bps). Likewise, the Italian 10-year note yield has dropped to 5.599% (-3.4-bps) while the Spanish 10-year note yield has slid to 6.140% (-1.6-bps); lower yields imply higher prices. RELATIVE PERFORMANCE (versus USD): 10:45 GMT GBP: +0.07%

JPY:+0.04%

CHF:-0.02%

EUR:-0.03%

NZD:-0.22%

CAD:-0.28%

AUD: -0.41%

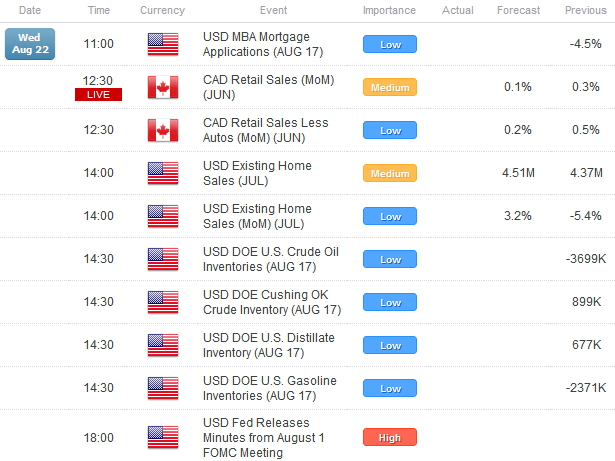

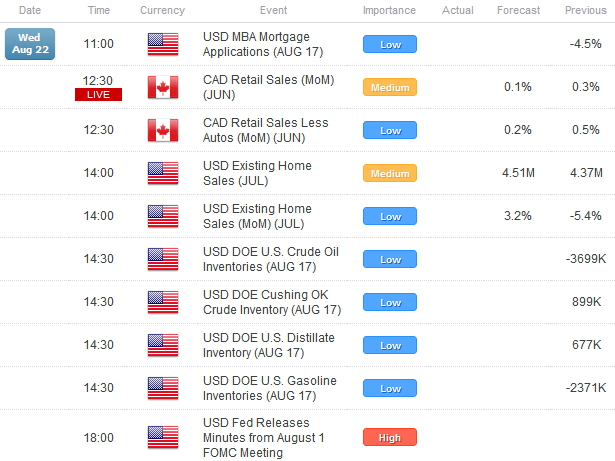

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.08% (-0.28% past 5-days) ECONOMIC CALENDAR  The docket is substantially more saturated today, in what is perhaps the most important day of the week. At 08:30 EDT / 12:30 GMT, the CAD Retail Sales report for June will be released, which is expected to show a modest improvement in spending. At 10:00 EDT / 14:00 GMT, the USD Existing Home Sales report for July will be released, and any gains aren't forecasted to outpace the slower pace experienced in June. The most important event of the week comes at 14:00 EDT / 18:00 GMT, when the USD Federal Reserve August Meeting Minutes are released.

As the drum beat for more quantitative easing has gone forth from financial institutions and the main stream media, the Federal Reserve remains ardent in its fight to remain on the sidelines as long as possible. The Federal Reserve's faith in the economy may be paying off, with Initial Jobless Claims holding lower and Nonfarm Payrolls having started to trend higher once more. But these news won't be reflected in these minutes; instead there will just be the hope that these employment indicators would pick up.

Accordingly, what's likely to be perceived is a mostly neutral Federal Reserve, hopeful for a better economy but willing to act if necessary, thus differing any attention to further accommodative policies further down the line in September (we think that the Jackson Hole Economic Policy Symposium will by and large be a bust, for those expecting an announcement). The US Dollar should be bolstered in the wake. The key pairs to watch are EURUSD and USDJPY.

TECHNICAL OUTLOOK

BB represents Bollinger Bands ® Finally, resolution! The EURUSD closed above the key 1.2405 and 1.2440/45 levels, signaling that further gains are likely, at least on a technical basis. Accordingly, the Inverse Head & Shoulders pattern off of the low is in play. Given the Head at 1.2040/45, this would draw into focus 1.2760 as long as price holds above 1.2405. Interim resistance comes in at 1.2500, 1.2560, 1.2625, and 1.2680. Near-term support comes in at 1.2440/45, 1.2405, 1.2310/30, 1.2250/65, and 1.2155/70. USDJPY:

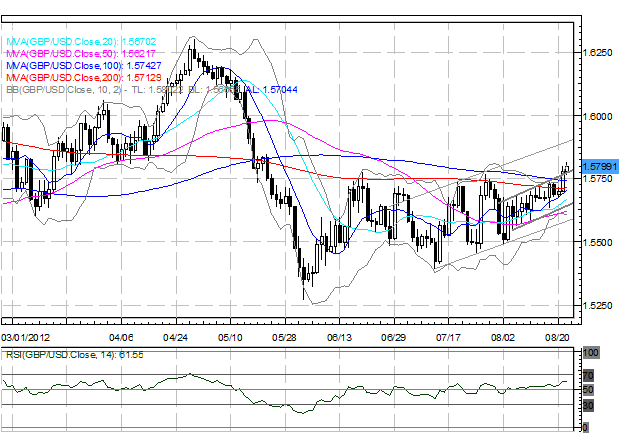

The USDJPY continues to come off the recent highs, as expected, given the short-term technical congestion that materialized. As long as prices closes above 79.20/25 (200-DMA), near-term resistance is in focus at 79.50/70 (August high, 100-DMA). A move about said level brings into focus the Neckline on the Inverse Head & Shoulders pattern at 80.60/65 (former swing highs in May and June). Interim support comes in at 79.15/20, 78.60 (former swing lows) and 78.10/20 (lows from last week). Resistance has broken in the short-term channel at 1.5770, opening up room for a run towards 1.5880/1.5900. This is the first close above both the 100-DMA and the 200-DMA since mid-May. Near-term support comes in at 1.5685/90 (10-DMA), 1.5635/40 (last week's low), and 1.5625 (ascending trendline support off of August 6 and August 10 lows). AUDUSD:  Failure above 1.0485/95 yesterday leads us to believe that the rally off of the recent low (and move to new August lows) keeps the short-term bearish perspective in place (though given pressure to the upside, we caution that a Bull Flag may be in place off of the August 9 high at 1.0613). At current price, daily support comes in at 1.0435/45 1.0400/10 (channel support dating back to June, 200-SMA on 4-hour chart) and 1.0380/85. Near-term resistance comes in at 1.0480, 1.0535/45 (former swing highs), 1.0580, 1.0600/15 (August high) and 1.0630. Should we see a rally up towards 1.0600 again, another failure would market a Double Top and signal a push for a test of 1.0195/1.0200 (100-DMA). --- Written by Christopher Vecchio, DailyFX Currency Analyst

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this email are provided as general market commentary, and do not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content in this email is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dailyfx has taken reasonable measures to ensure the accuracy of the information, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the content, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this email. Please read the full disclosures here. Additionally, Dailyfx takes your privacy seriously. Please click here to read our privacy policy. |  Related Blog Posts Related Blog Posts |  Subscribe via RSS Subscribe via RSS *Get live updates in your web browser window. | |

Leave a comment