| By Christopher Vecchio, DailyFX Currency Analyst

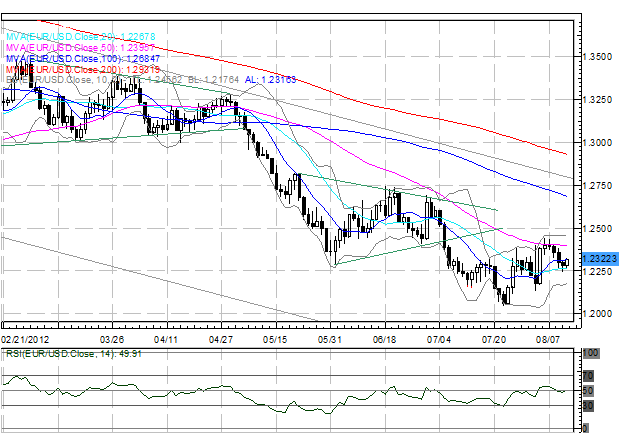

The US Dollar has moved mostly sideways amid quiet trading conditions, which in turn has paved the way for a modest rebound by the Euro. The EURUSD has moved back above 1.2300, finding support on its 20-DMA, and amid further tempered conditions (which we believe are likely to persist for at least the next two-weeks, barring unforeseen event risk out of Europe), we believe that prices should remain range bound for the foreseeable future.

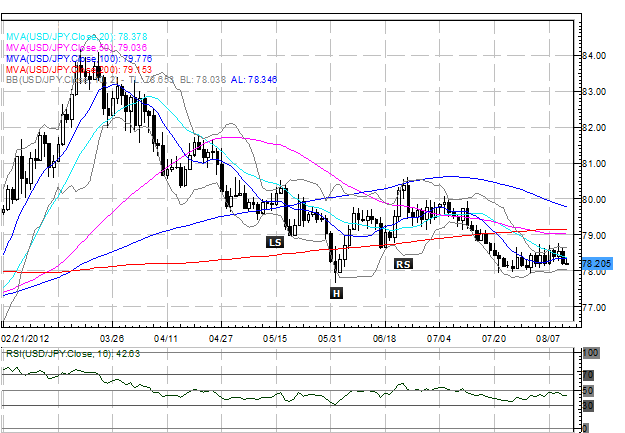

Meanwhile, after a wide miss on the second quarter growth figure, the Japanese Yen's fundamental momentum has been halted, leaving it vulnerable to further declines. The Bank of Japan has thus far withheld new stimulative measures, but the sharp drop in spending in the second quarter is likely to raise some eyebrows. Should the Yen retain its strength and growth continues to wane, policymakers will resort to the weakening the safe haven in order to spur more favorable trade conditions; we suspect that the Bank of Japan and/or the Ministry of Finance will work to cultivate a brighter growth picture vis-à-vis a weaker Yen or additional stimulus by the end of the year.

In part, the Euro's advance today has been aided by modest improvements in peripheral European sovereign debt yields; each day that bond yields don't spike higher should be considered bullish for the Euro, even if yields move sideways if not add a few basis-points, just like today. The Italian 2-year note yield has inched up to 3.352% (+1.0-bps) while the Spanish 2-year note yield has perked up to 4.037% (+1.2-bps). On the other hand, the Italian 10-year note yield has dropped to 5.825% (-5.2-bps) while the Spanish 10-year note yield has fallen to 6.761% (-8.4-bps); lower yields imply higher prices. RELATIVE PERFORMANCE (versus USD): 10:30 GMT

EUR: +0.29%

CHF:+0.28%

JPY:+0.08%

CAD:-0.03%

GBP:-0.04%

AUD:-0.19%

NZD: -0.21%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.15%(-0.02% past 5-days) ECONOMIC CALENDAR There are no data due on Monday in the North American trading session. As such, we suspect that headlines and news will have a great influence on price action should they materialize, though given recent trading volumes, the implication is for a quiet day to the start the week.

TECHNICAL OUTLOOK

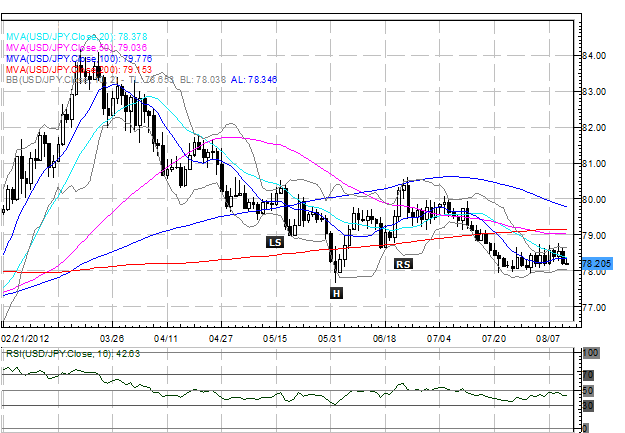

More sideways price action in the EURUSD as the 20-DMA provided support today; though the rally off of the July 24 low appears to be corrective in nature, with three waves evident from the bottom (A-B-C correction). This suggests that further downside is likely; in our opinion, this translates to one more new low near the 2010 low of 1.1875 before the start of the next major bull leg. A drop towards 1.1695-1.1875 remains likely by mid-September. Near-term resistance comes in at 1.2310/30, 1.2400/05, and 1.2440/45. Daily support comes in at 1.2200/20 and 1.2155/70. The Inverse Head & Shoulders (Head at 1.2040/45, Neckline at 1.2400/05, Measured Move 1.2750/60) remains a potential outcome. USDJPY:

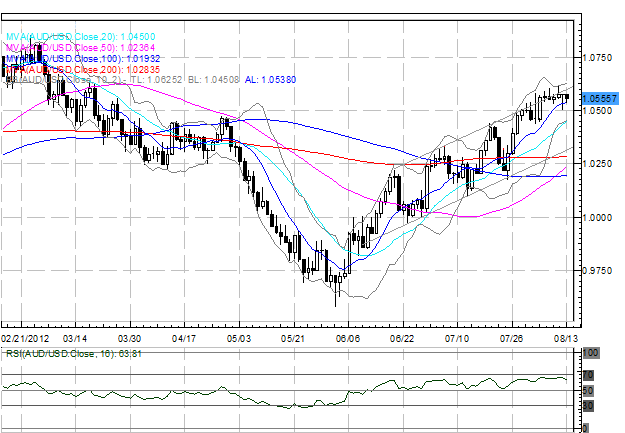

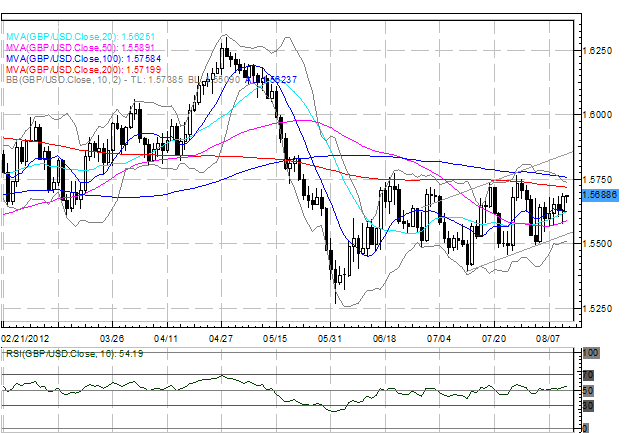

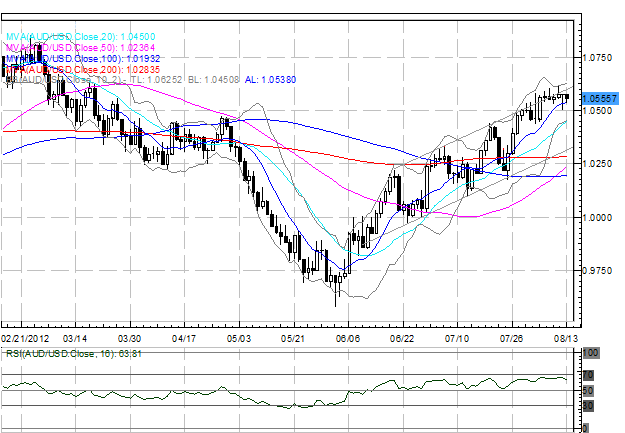

A pattern long in the making, the USDJPY Inverse Head & Shoulder formation that has been in wait-and-see mode remains valid so long as the Head at 77.60/70 holds. Indeed, it has, and after the Fed meeting and the July Nonfarm Payrolls two-weeks ago and the disappointing second quarter Japanese GDP this week, the USDJPY is constructive in the neat-term, fundamentally. Accordingly, with the Head at 77.60/70, this suggests a measured move towards 83.60/70 once initiated. Near-term resistance comes in at 79.15/20 (200-DMA). Price action to remain range bound as long as advances are capped by 80.60/70. On the hourly charts, it appears a Rounded Bottom is forming (yesterday was the highest exchange rate since July 20), and we are thus biased higher for now. Last week I wrote "the muddle sideways continues, leaving little changed of our outlook for the GBPUSD. Overall, our outlook unchanged from Monday [August 6]. With the ascending trendline off of the July 12 and July 25 lows holding, our bias is neutral. A daily close below 1.5580/85 (50-DMA) would be bearish, whereas a close below 1.5490/1.5520 would be very bearish (as it would represent a break of the channel as well as last week's lows)." Our view remains. Near-term resistance is 1.5700/05 (August high), 1.5720 (200-DMA), and 1.5755/70 (July high, 100-DMA). Daily support is 1.5620/25 (10-DMA, 20-DMA) 1.5575/80, 1.5490/1.5520, then 1.5450/60 (July 25 low). AUDUSD:  Last week I wrote "the pair's exhaustion above 1.0600 (failure to see a daily close above said level) has stoked a pullback, and with a fundamental catalyst (Chinese worries), near-term price action is biased lower." Prices continue to consolidate, and it very much appears that a Top is being formed on the 4-hour charts. Daily resistance comes in at 1.0580, 1.0600/15 and 1.0630. Near-term support comes in at 1.0535/45 (former swing highs), 1.0480/1.0500 (last week's low), 1.0435/45, and 1.0380/85. --- Written by Christopher Vecchio, DailyFX Currency Analyst

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this email are provided as general market commentary, and do not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content in this email is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dailyfx has taken reasonable measures to ensure the accuracy of the information, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the content, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this email. Please read the full disclosures here. Additionally, Dailyfx takes your privacy seriously. Please click here to read our privacy policy. |  Related Blog Posts Related Blog Posts |  Subscribe via RSS Subscribe via RSS *Get live updates in your web browser window. | |

Leave a comment