| By Joel Kruger, DailyFX Technical Strategist

Talking Points

- Greek election results produce favorable risk reaction

- Pro bailout party wins election

- Technical picture remains guiding light throughout

- G20 meeting to likely inspire fresh volatility

- Reports of formal EU plan to tackle crisis

Although the Eurozone is far from out of the woods, the initial market reaction to the Greek election has been a net positive as the worst case scenarios of imminent Greek exit from the Euro are priced out. While there is still a good deal of speculation and expectation that a Grexit is inevitable, the news that a pro bailout party has won, is definitely somewhat reassuring for overall risk appetite.

Technically, the move higher falls directly in line with our projections, where we have been calling for additional strength in the Euro towards the 1.2800-1.3000 area before the next medium-term lower top will be finally sought out ahead of underlying bear trend resumption. Right now, the election results are helping to catalyze this latest technical upside momentum, and from here attention will shift to today's and tomorrow's G20 meeting, and reaction from the Greek election and impact on Spanish and Italian bond spreads.

Also seen helping to support risk a bit have been articles out of the UK Telegraph and New York times which report of a formal EU plan on the horizon which will help to tackle many of the region's problems. One of the major criticisms of the Eurozone crisis has been a lack of leadership, and should officials indeed be able to produce a formal plan, it will undoubtedly be well received.

At this point, it also looks as though the Euro drop that we saw in previous weeks below 1.2300 may have been on an expectation for a worst case scenario in Greece and the peripheral Eurozone countries. As such, the ensuing rally continues to be the pricing out of that downside risk. What this also means, is that we are in no way advocating a sustained risk on trade environment, and that once the worst of the Greek elections are priced out, we very well could see some renewed risk off trade. For today, we think it is still best to stay sidelined, at least early in the day.

ECONOMIC CALENDAR TECHNICAL OUTLOOK

The market is in the process of correcting from some violently oversold levels after breaking to yearly lows just under 1.2300. While our overall outlook remains grossly bearish, from here we still see room for short-term upside before a fresh lower top is sought out. Look for the latest positive weekly close to open the door for acceleration into the 1.2800-1.3000 area, where fresh offers are likely to re-emerge. Setbacks should be well supported ahead of 1.2400. USD/JPY:

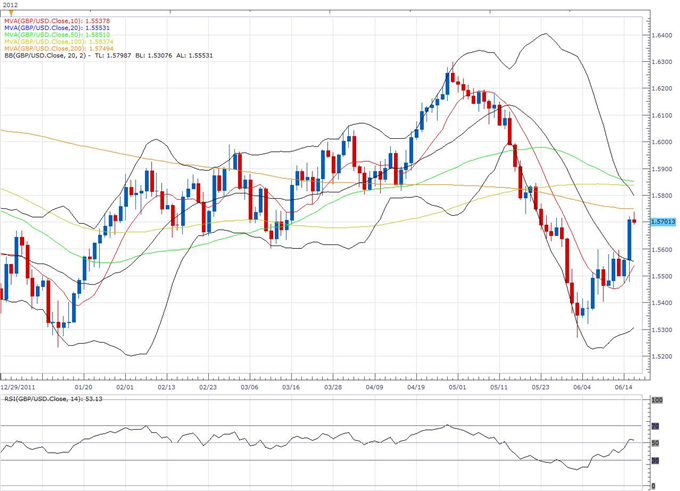

The latest setbacks have been rather intense, with the market collapsing through the 200-Day SMA before finally finding support by 77.65. We have since seen attempts at recovery and we contend that the market should continue to break higher, with sights ultimately set on a retest and break of the 2012 highs by 84.20 further up. However, at this point, we will need to see a break and close back above 80.00 to officially alleviate downside pressures and reaffirm bullish outlook. Daily studies are now correcting from oversold and from here risks seem tilted to the upside to allow for a necessary short-term corrective bounce after setbacks stalled just shy of the 2012 lows from January. Look for additional upside towards the 1.5800-1.6000 from where a more meaningful lower top is sought out ahead of bearish resumption. USD/CHF:  While we retain a broader bullish outlook for this pair, with the market seen establishing back above parity over the coming weeks, shorter-term risks are for more of a corrective pullback to allow for the market to establish a fresh higher low. As such, we see risks for weakness over the coming sessions towards the 0.9200-0.9300 area before the market looks to reassert its bullish momentum and broader uptrend. --- Written by Joel Kruger, DailyFX Technical Currency Strategist

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this email are provided as general market commentary, and do not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content in this email is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dailyfx has taken reasonable measures to ensure the accuracy of the information, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the content, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this email. Please read the full disclosures here. Additionally, Dailyfx takes your privacy seriously. Please click here to read our privacy policy. |  Related Blog Posts Related Blog Posts |  Subscribe via RSS Subscribe via RSS *Get live updates in your web browser window. | |

Leave a comment